I Will Teach You to Be Rich - Ramit Sethi

Note: While reading a book whenever I come across something interesting, I highlight it on my Kindle. Later I turn those highlights into a blogpost. It is not a complete summary of the book. These are my notes which I intend to go back to later. Let’s start!

-

Establishing good credit is the first step in building an infrastructure for getting rich. Think about it: Our largest purchases are almost always made on credit, and people with good credit save tens of thousands of dollars on these purchases. Credit has a far greater impact on your finances than saving a few dollars a day on a cup of coffee

-

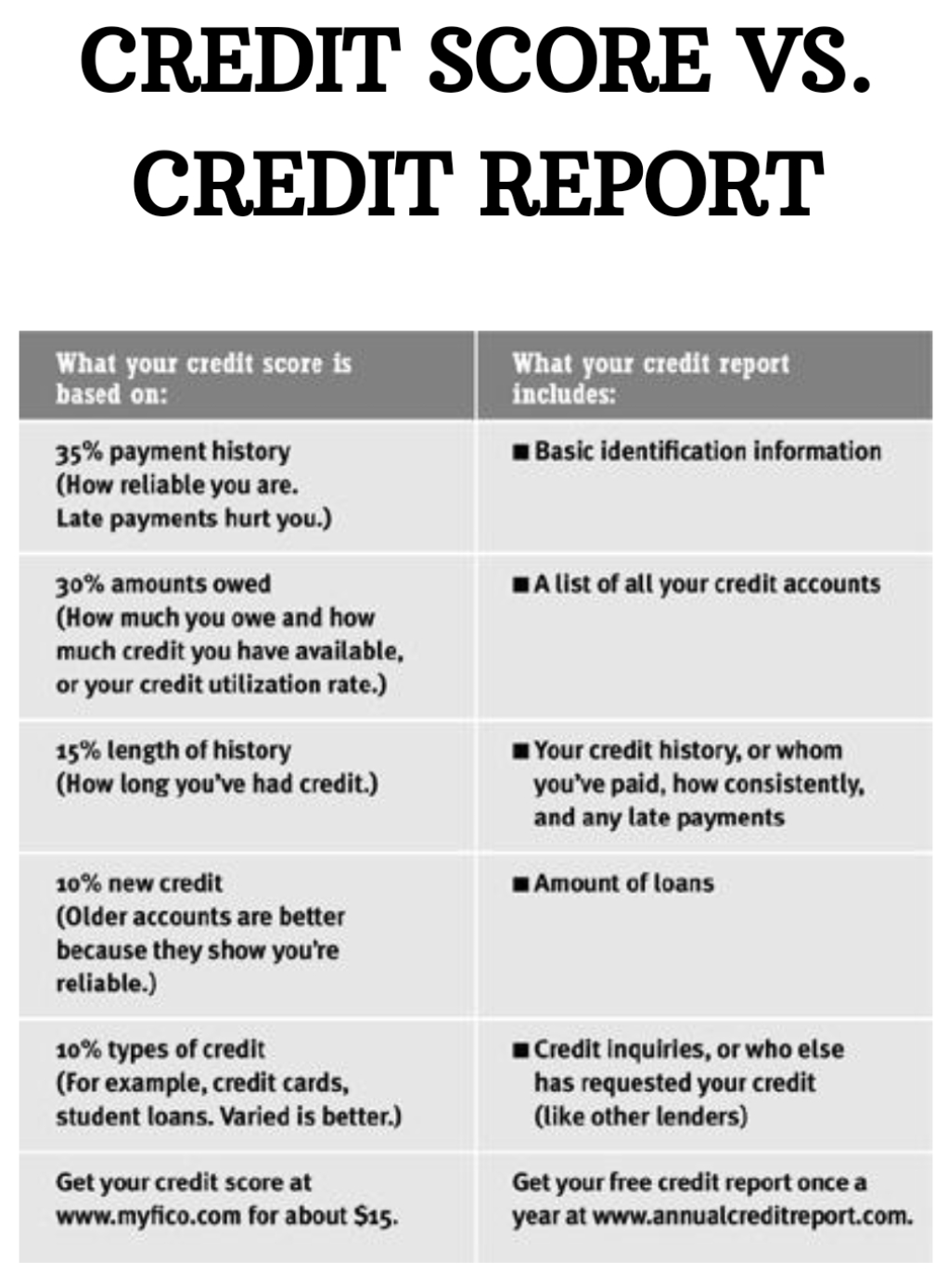

There are two main components to credit (also known as your credit history): the credit report and the credit score

-

Your credit report gives potential lenders—the people who are considering lending you money for a car or home—basic information about you, your accounts, and your payment history. In general, it tracks all credit-related activities, although recent activities are given higher weight

-

Avoid cash-back cards, which don’t actually pay you much cash

-

Rewards are important. You’re going to be using this card a fair amount, so make sure the rewards it offers are something you’ll actually want. I travel a lot, so I got an airline card that gives me free companion tickets, free flights, and points for every dollar I spend and every mile I fly. I get multiple free flights per year, and each one saves me about $350

-

If you’re getting a rewards card, find one that gives you something you value

-

Pay off your credit card regularly.Yeah, we’ve all heard it, but what you may not know is that your debt payment history represents 35 percent of your credit score—the largest chunk

- If you miss even one payment on your credit card, here are four terrible, horrible, no good, very bad results you may face:

- Your credit score can drop more than 100 points, which would add $240/month to an average thirty-year fixed-mortgage loan

- Your APR can go up to 30 percent

- You’ll be charged a late fee, usually around $35

- Your late payment can trigger rate increases on your other credit cards as well, even if you’ve never been late on them

-

Most people pay their credit card bills online now, but if you haven’t set up automatic payment yet, log on to your credit card’s website to set it up now

-

Get all fees waived on your card.This is a great, easy way to optimize your credit cards because your credit card company will do all the work for you. Call them using the phone number on the back of the card and ask if you’re paying any fees, including annual fees or service charges

-

Most people should switch from a for-fee card to a free card, so ask your credit card company what they’ll do for you. If they waive your fees, great! If not, switch to a no-fee credit card. I suggest you do this at the same credit card company to simplify your life—and so you don’t have to close one account and open another, which will affect your credit score. If you decide to close the account and get a new credit card, look for one with no fees and good rewards

-

Negotiate a lower APR. Your APR, or annual percentage rate, is the interest rate your credit card company charges you. The average APR is 14 percent, which makes it extremely expensive if you carry a balance on your card. Put another way, since you can make an average of about 8 percent in the stock market, your credit card is getting a great deal by lending you money. If you could get a 14 percent return, you’d be thrilled—you want to avoid the black hole of credit card interest payments so you can earn money, not give it to the credit card companies.So, call your credit card company and ask them to lower your APR. If they ask why, tell them you’ve been paying the full amount of your bill on time for the last few months, and you know there are a number of credit cards offering better rates than you’re currently getting. In my experience, this works about half the time. It’s important to note that your APR doesn’t technically matter if you’re paying your bills in full every month—you could have a 2 percent APR or 80 percent APR and it would be irrelevant, since you don’t pay interest if you pay your total bill in each month. But this is a quick and easy way to pick the low-hanging fruit with one phone call

-

Keep your cards for a long time and keep them active.Lenders like to see a long history of credit, which means that the longer you hold an account, the more valuable it is for your credit score. Don’t get suckered by introductory offers and low APRs. If you’re happy with your card, keep it. And if you’re getting a new credit card, don’t close the account on your old one. That can negatively affect your credit score. As long as there are no fees, keep it open and use it occasionally, because some credit card companies will cancel your account after a certain period of inactivity. To avoid having your account shut down, set up an automatic payment on any card that is not your primary card. For example, I set it up so that one of my credit cards pays a $12.95 monthly subscription through my checking account each month, which requires zero intervention on my part. But my credit report reflects that I’ve had the card for more than five years, which improves my credit score. Play it safe: If you have a credit card, keep it active using an automatic payment at least once every three months

-

Get more credit to improve something called your credit utilization rate, which is simply how much you owe divided by your available credit. This makes up 30 percent of your credit score. For example, if you owe $4,000 and have $4,000 in total available credit, your ratio is 100 percent (4,000 ÷ 4,000 × 100), which is bad. If, however, you owe only $1,000 but have $4,000 in available credit, your credit utilization rate is a much better 25 percent ($1,000 ÷ $4,000 × 100). Lower is preferred because lenders don’t want you regularly spending all the money you have available through credit—it’s too likely that you’ll default and not pay them anything.To improve your credit utilization rate, you have two choices: Stop carrying so much debt on your credit cards (even if you pay it off each month) or increase your total available credit

-

I request a credit-limit increase every six to twelve months. Remember, 30 percent of your credit score is represented by your credit utilization rate. To improve it, the first thing you should do is pay off your debt. If you’ve already paid off your debt, only then should you try to increase your available credit

-

Whenever you make a call regarding a dispute on your credit card, you wouldn’t believe how powerful it is to refer back to the last time you called—citing the rep’s name, date of conversation, and your call notes. Most credit card reps you talk to will simply give in because they know you came to play in the big leagues.When you use this to confront a credit card company or bank with data from your last calls, you’ll be more prepared than 99 percent of other people—and chances are, you’ll get what you want

-

Before I get into rewards programs, let me say this: Just like with car insurance, you can get great deals on your credit when you’re a responsible customer. In fact, there are lots of tips for people who have very good credit. If you fall in this category, you should call your credit cards and lenders once per year to ask them what advantages you’re eligible for. Often, they can waive fees, extend credit, and give you private promotions that others don’t have access to. Call them up and use this line:“Hi there. I just checked my credit and noticed that I have a 750 credit score, which is pretty good. I’ve been a customer of yours for the last four years, so I’m wondering what special promotions and offers you have for me . . . I’m thinking of fee waivers and special offers that you use for customer retention.”Credit cards also offer rewards programs that give you cash back, airline tickets, and other benefits, but most people don’t take advantage of all the free stuff they can get

-

Once, when I canceled my Sprint cell phone service, they told me my account had a $160 charge. For what? I asked. Wait for it. . . .“An early cancellation fee.”Yeah, right. I knew I didn’t have a contract, and I had negotiated out of an early cancellation fee a long time before that. (Cell phone companies make a lot of money from trying these shady moves, hoping customers will get frustrated, give up, and just pay.) Unfortunately for them, ever since Sprint had started trying to rip me off three years before, I had kept records of every phone conversation I’d had with them. The customer-service rep was very polite, but insisted she couldn’t do anything to erase the charge.Really? I’ve heard this tune before, so I pulled out the notes I had taken the previous year and politely read them aloud to her.As soon as I read them, I experienced a miraculous change in her ability to waive the fee. Within two minutes, my account was cleared and I was off the phone. Amazing!!!!! Thank you, madam!!!Wouldn’t it be great if that were the end of the story? Although they told me they wouldn’t charge me, they did it anyway. By this point, I was so fed up that I called in the big guns.Many people don’t know that credit cards offer excellent consumer protection. This is one reason I encourage everyone to make major purchases on their credit card (and not use cash or a debit card).I called my credit card company and told them I wanted to dispute a charge. They said, “Sure; what’s your address and what’s the amount?” When I told them about my experience with Sprint, they instantly gave me a temporary credit for the amount and told me to mail in a form with my complaint, which I did.Two weeks later, the complaint was totally resolved in my favor.What happens in disputes like this is that the credit card company fights the merchant for you. This works with all credit cards. Keep this in mind for future purchases that go wrong

-

Credit card provides amazing consumer protection. Here are a few examples you might not know about: Automatic warranty doubling: Most cards extend the warranty on your purchases. So if you buy an iPod and it breaks after Apple’s warranty expires, your credit card will still cover it up to an additional year. This is true for nearly every credit card for nearly every purchase, automatically. Car rental insurance: If you rent a car, don’t let them bully you into getting the extra collision insurance. It’s completely worthless! You already have coverage through your car insurance, plus your credit card will usually back you up to $50,000. Trip-cancellation insurance: If you book tickets for a vacation and then get sick and can’t travel, your airline will charge you hefty fees to re-book your ticket. Just call your credit card and ask for the trip-cancellation insurance to kick in, and they’ll cover those change fees—usually up to $1,000 per year. Concierge services: When I couldn’t find LA Philharmonic tickets last year, I called my credit card and asked the concierge to try to find some. He called me back in two days with tickets. They charged me (a lot, actually), but he was able to get them when nobody else could

-

My digital camera broke about eighteen months after I bought it. The manufacturer’s warranty expired after twelve months, but I knew that American Express extended warranties on electronics for an extra year. I called American Express and explained the problem. They just asked how much I had paid for the camera, and one week later I had a check for the full purchase price in my mailbox.—RAVI GOGIA, 26

-

Avoid closing your accounts (usually). Although closing an account doesn’t technically harm your credit score, it means you then have less available credit—with the same amount of debt. (For example, having $2,000 in debt and $8,000 in available credit is better than having the same debt with only $4,000 in credit

-

People with zero debt get a free pass. If you have no debt, close as many accounts as you want. It won’t affect your credit utilization score

-

Think ahead before closing accounts. If you’re applying for a major loan—for a car, home, or education—don’t close any accounts within six months of filing the loan application. You want as much credit as possible when you apply

-

For instance, the number one mistake people make with their credit cards is carrying a balance, or not paying it off every month. The key to using credit cards effectively is to pay off your credit card in full every month

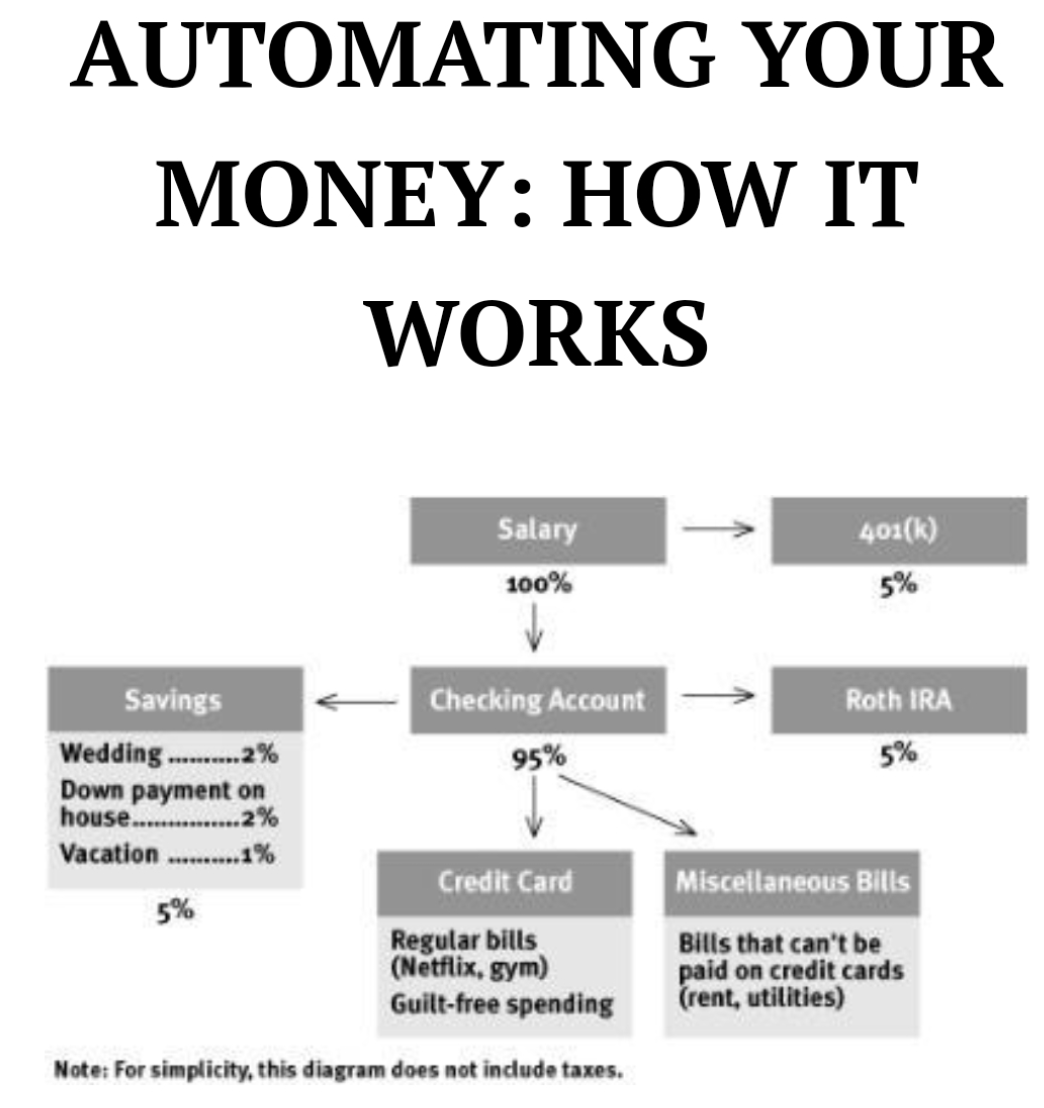

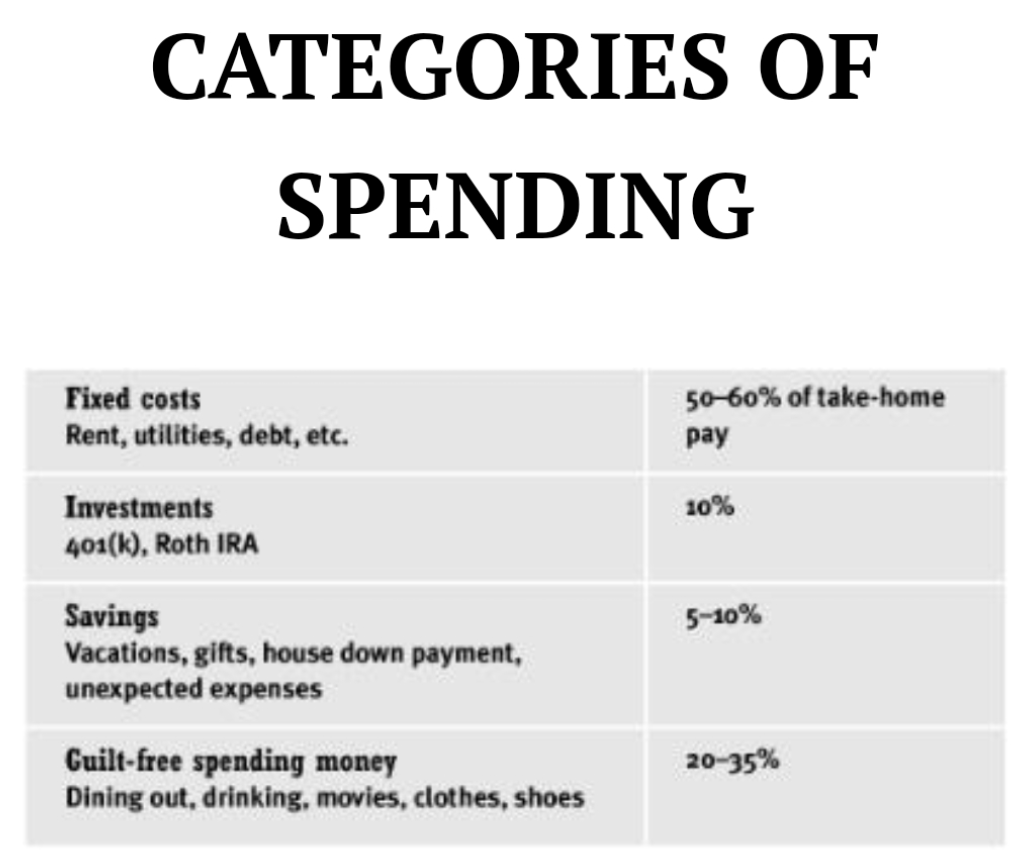

- A Conscious Spending Plan involves four major buckets where your money will go: Fixed Costs, Investments, Savings, and Guilt-free Spending Money

- The Envelope System:

- Decide how much you want to spend in major categories each month. (Not sure? Start with one: Eating out.)

- Put money in each envelope (category)

- You can transfer from one envelope to another . . .. . . but when the envelopes are empty, that’s it for the month

- To find your annual salary, just take your hourly rate, double it, and add three zeros to the end. If you make $20/hour, you make approximately $40,000/year. If you make $30/hour, you make approximately $60,000/year.This also works in reverse. To find your hourly rate, divide your salary by two and drop the three zeros. So $50,000/year becomes approximately $25/hour.This is based on a general forty-hour workweek and doesn’t include taxes