Zero to One - Peter Thiel

-

Doing what we already know how to do takes the world from 1 to n, adding more of something familiar. But every time we create something new, we go from 0 to 1. The act of creation is singular, as is the moment of creation, and the result is something fresh and strange

-

When we think about the future, we hope for a future of progress. That progress can take one of two forms. Horizontal or extensive progress means copying things that work—going from 1 to n. Horizontal progress is easy to imagine because we already know what it looks like. Vertical or intensive progress means doing new things—going from 0 to 1. Vertical progress is harder to imagine because it requires doing something nobody else has ever done. If you take one typewriter and build 100, you have made horizontal progress. If you have a typewriter and build a word processor, you have made vertical progress

-

At the macro level, the single word for horizontal progress is globalization—taking things that work somewhere and making them work everywhere. China is the paradigmatic example of globalization; its 20-year plan is to become like the United States is today. The Chinese have been straightforwardly copying everything that has worked in the developed world: 19th-century railroads, 20th-century air conditioning, and even entire cities. They might skip a few steps along the way—going straight to wireless without installing landlines, for instance—but they’re copying all the same

-

The single word for vertical, 0 to 1 progress is technology. The rapid progress of information technology in recent decades has made Silicon Valley the capital of “technology” in general. But there is no reason why technology should be limited to computers. Properly understood, any new and better way of doing things is technology

-

Because globalization and technology are different modes of progress, it’s possible to have both, either, or neither at the same time. For example, 1815 to 1914 was a period of both rapid technological development and rapid globalization. Between the First World War and Kissinger’s trip to reopen relations with China in 1971, there was rapid technological development but not much globalization. Since 1971, we have seen rapid globalization along with limited technological development, mostly confined to IT

-

“Perfect competition” is considered both the ideal and the default state in Economics 101. So-called perfectly competitive markets achieve equilibrium when producer supply meets consumer demand

-

Every firm in a competitive market is undifferentiated and sells the same homogeneous products. Since no firm has any market power, they must all sell at whatever price the market determines. If there is money to be made, new firms will enter the market, increase supply, drive prices down, and thereby eliminate the profits that attracted them in the first place. If too many firms enter the market, they’ll suffer losses, some will fold, and prices will rise back to sustainable levels. Under perfect competition, in the long run no company makes an economic profit

-

The opposite of perfect competition is monopoly. Whereas a competitive firm must sell at the market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes its profits

-

Capitalism and competition are opposites. Capitalism is premised on the accumulation of capital, but under perfect competition all profits get competed away. The lesson for entrepreneurs is clear: if you want to create and capture lasting value, don’t build an undifferentiated commodity business

- Non-monopolists exaggerate their distinction by defining their market as the intersection of various smaller markets:

- British food ∩ restaurant ∩ Palo Alto

- Rap star ∩ hackers ∩ sharks

- Monopolists, by contrast, disguise their monopoly by framing their market as the union of several large markets:

- search engine ∪ mobile phones ∪ wearable computers ∪ self-driving cars

-

In business, money is either an important thing or it is everything. Monopolists can afford to think about things other than making money; non-monopolists can’t. In perfect competition, a business is so focused on today’s margins that it can’t possibly plan for a long-term future. Only one thing can allow a business to transcend the daily brute struggle for survival: monopoly profits

-

Every monopoly is unique, but they usually share some combination of the following characteristics: proprietary technology, network effects, economies of scale, and branding

-

Proprietary technology is the most substantive advantage a company can have because it makes your product difficult or impossible to replicate. Google’s search algorithms, for example, return results better than anyone else’s. Proprietary technologies for extremely short page load times and highly accurate query autocompletion add to the core search product’s robustness and defensibility. It would be very hard for anyone to do to Google what Google did to all the other search engine companies in the early 2000s

-

As a good rule of thumb, proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage. Anything less than an order of magnitude better will probably be perceived as a marginal improvement and will be hard to sell, especially in an already crowded market

-

The clearest way to make a 10x improvement is to invent something completely new. If you build something valuable where there was nothing before, the increase in value is theoretically infinite. A drug to safely eliminate the need for sleep, or a cure for baldness, for example, would certainly support a monopoly business

-

Or you can radically improve an existing solution: once you’re 10x better, you escape competition. PayPal, for instance, made buying and selling on eBay at least 10 times better. Instead of mailing a check that would take 7 to 10 days to arrive, PayPal let buyers pay as soon as an auction ended. Sellers received their proceeds right away, and unlike with a check, they knew the funds were good

-

Network effects make a product more useful as more people use it. For example, if all your friends are on Facebook, it makes sense for you to join Facebook, too. Unilaterally choosing a different social network would only make you an eccentric

-

Network effects can be powerful, but you’ll never reap them unless your product is valuable to its very first users when the network is necessarily small. For example, in 1960 a quixotic company called Xanadu set out to build a two-way communication network between all computers—a sort of early, synchronous version of the World Wide Web. After more than three decades of futile effort, Xanadu folded just as the web was becoming commonplace. Their technology probably would have worked at scale, but it could have worked only at scale: it required every computer to join the network at the same time, and that was never going to happen

-

Paradoxically, then, network effects businesses must start with especially small markets. Facebook started with just Harvard students—Mark Zuckerberg’s first product was designed to get all his classmates signed up, not to attract all people of Earth. This is why successful network businesses rarely get started by MBA types: the initial markets are so small that they often don’t even appear to be business opportunities at all

-

A monopoly business gets stronger as it gets bigger: the fixed costs of creating a product (engineering, management, office space) can be spread out over ever greater quantities of sales. Software startups can enjoy especially dramatic economies of scale because the marginal cost of producing another copy of the product is close to zero

-

Many businesses gain only limited advantages as they grow to large scale. Service businesses especially are difficult to make monopolies. If you own a yoga studio, for example, you’ll only be able to serve a certain number of customers. You can hire more instructors and expand to more locations, but your margins will remain fairly low and you’ll never reach a point where a core group of talented people can provide something of value to millions of separate clients, as software engineers are able to do

-

A good startup should have the potential for great scale built into its first design. Twitter already has more than 250 million users today. It doesn’t need to add too many customized features in order to acquire more, and there’s no inherent reason why it should ever stop growing

-

A company has a monopoly on its own brand by definition, so creating a strong brand is a powerful way to claim a monopoly. Today’s strongest tech brand is Apple: the attractive looks and carefully chosen materials of products like the iPhone and MacBook, the Apple Stores’ sleek minimalist design and close control over the consumer experience, the omnipresent advertising campaigns, the price positioning as a maker of premium goods, and the lingering nimbus of Steve Jobs’s personal charisma all contribute to a perception that Apple offers products so good as to constitute a category of their own

-

Many have tried to learn from Apple’s success: paid advertising, branded stores, luxurious materials, playful keynote speeches, high prices, and even minimalist design are all susceptible to imitation. But these techniques for polishing the surface don’t work without a strong underlying substance. Apple has a complex suite of proprietary technologies, both in hardware (like superior touchscreen materials) and software (like touchscreen interfaces purpose-designed for specific materials). It manufactures products at a scale large enough to dominate pricing for the materials it buys. And it enjoys strong network effects from its content ecosystem: thousands of developers write software for Apple devices because that’s where hundreds of millions of users are, and those users stay on the platform because it’s where the apps are. These other monopolistic advantages are less obvious than Apple’s sparkling brand, but they are the fundamentals that let the branding effectively reinforce Apple’s monopoly

-

Beginning with brand rather than substance is dangerous. Ever since Marissa Mayer became CEO of Yahoo! in mid-2012, she has worked to revive the once-popular internet giant by making it cool again. In a single tweet, Yahoo! summarized Mayer’s plan as a chain reaction of “people then products then traffic then revenue.” The people are supposed to come for the coolness: Yahoo! demonstrated design awareness by overhauling its logo, it asserted youthful relevance by acquiring hot startups like Tumblr, and it has gained media attention for Mayer’s own star power. But the big question is what products Yahoo! will actually create. When Steve Jobs returned to Apple, he didn’t just make Apple a cool place to work; he slashed product lines to focus on the handful of opportunities for 10x improvements. No technology company can be built on branding alone

-

Every startup is small at the start. Every monopoly dominates a large share of its market. Therefore, every startup should start with a very small market. Always err on the side of starting too small. The reason is simple: it’s easier to dominate a small market than a large one. If you think your initial market might be too big, it almost certainly is

-

The perfect target market for a startup is a small group of particular people concentrated together and served by few or no competitors. Any big market is a bad choice, and a big market already served by competing companies is even worse. This is why it’s always a red flag when entrepreneurs talk about getting 1% of a $100 billion market. In practice, a large market will either lack a good starting point or it will be open to competition, so it’s hard to ever reach that 1%. And even if you do succeed in gaining a small foothold, you’ll have to be satisfied with keeping the lights on: cutthroat competition means your profits will be zero

-

If your company can be summed up by its opposition to already existing firms, it can’t be completely new and it’s probably not going to become a monopoly

-

PayPal could be seen as disruptive, but we didn’t try to directly challenge any large competitor. It’s true that we took some business away from Visa when we popularized internet payments: you might use PayPal to buy something online instead of using your Visa card to buy it in a store. But since we expanded the market for payments overall, we gave Visa far more business than we took. The overall dynamic was net positive, unlike Napster’s negative-sum struggle with the U.S. recording industry. As you craft a plan to expand to adjacent markets, don’t disrupt: avoid competition as much as possible

-

Leanness is a methodology, not a goal. Making small changes to things that already exist might lead you to a local maximum, but it won’t help you find the global maximum. You could build the best version of an app that lets people order toilet paper from their iPhone. But iteration without a bold plan won’t take you from 0 to 1. A company is the strangest place of all for an indefinite optimist: why should you expect your own business to succeed without a plan to make it happen?

-

A business with a good definite plan will always be underrated in a world where people see the future as random

- To anticipate likely sources of misalignment in any company, it’s useful to distinguish between three concepts:

- Ownership: who legally owns a company’s equity?

- Possession: who actually runs the company on a day-to-day basis?

- Control: who formally governs the company’s affairs?

-

A typical startup allocates ownership among founders, employees, and investors. The managers and employees who operate the company enjoy possession. And a board of directors, usually comprising founders and investors, exercises control

-

If you’re deciding whether to bring someone on board, the decision is binary. Ken Kesey was right: you’re either on the bus or off the bus

-

Cash is attractive. It offers pure optionality: once you get your paycheck, you can do anything you want with it. However, high cash compensation teaches workers to claim value from the company as it already exists instead of investing their time to create new value in the future. A cash bonus is slightly better than a cash salary—at least it’s contingent on a job well done. But even so-called incentive pay encourages short-term thinking and value grabbing. Any kind of cash is more about the present than the future

-

Recruiting is a core competency for any company. It should never be outsourced. You need people who are not just skilled on paper but who will work together cohesively after they’re hired. The first four or five might be attracted by large equity stakes or high-profile responsibilities. More important than those obvious offerings is your answer to this question: Why should the 20th employee join your company? Talented people don’t need to work for you; they have plenty of options. You should ask yourself a more pointed version of the question: Why would someone join your company as its 20th engineer when she could go work at Google for more money and more prestige?

- The best thing I did as a manager at PayPal was to make every person in the company responsible for doing just one thing. Every employee’s one thing was unique, and everyone knew I would evaluate him only on that one thing. I had started doing this just to simplify the task of managing people. But then I noticed a deeper result: defining roles reduced conflict. Most fights inside a company happen when colleagues compete for the same responsibilities. Startups face an especially high risk of this since job roles are fluid at the early stages. Eliminating competition makes it easier for everyone to build the kinds of long-term relationships that transcend mere professionalism. More than that, internal peace is what enables a startup to survive at all. When a startup fails, we often imagine it succumbing to predatory rivals in a competitive ecosystem. But every company is also its own ecosystem, and factional strife makes it vulnerable to outside threats. Internal conflict is like an autoimmune disease: the technical cause of death may be pneumonia, but the real cause remains hidden from plain view

-

Superior sales and distribution by itself can create a monopoly, even with no product differentiation. The converse is not true. No matter how strong your product—even if it easily fits into already established habits and anybody who tries it likes it immediately—you must still support it with a strong distribution plan

-

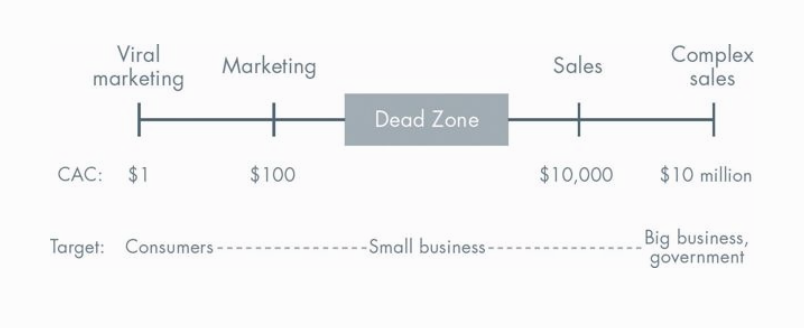

Two metrics set the limits for effective distribution. The total net profit that you earn on average over the course of your relationship with a customer (Customer Lifetime Value, or CLV) must exceed the amount you spend on average to acquire a new customer (Customer Acquisition Cost, or CAC). In general, the higher the price of your product, the more you have to spend to make a sale—and the more it makes sense to spend it

-

If your average sale is seven figures or more, every detail of every deal requires close personal attention. It might take months to develop the right relationships. You might make a sale only once every year or two. Then you’ll usually have to follow up during installation and service the product long after the deal is done. It’s hard to do, but this kind of “complex sales” is the only way to sell some of the most valuable products. SpaceX shows that it can be done. Within just a few years of launching his rocket startup, Elon Musk persuaded NASA to sign billion-dollar contracts to replace the decommissioned space shuttle with a newly designed vessel from SpaceX. Politics matters in big deals just as much as technological ingenuity, so this wasn’t easy. SpaceX employs more than 3,000 people, mostly in California. The traditional U.S. aerospace industry employs more than 500,000 people, spread throughout all 50 states. Unsurprisingly, members of Congress don’t want to give up federal funds going to their home districts. But since complex sales requires making just a few deals each year, a sales grandmaster like Elon Musk can use that time to focus on the most crucial people—and even to overcome political inertia. Complex sales works best when you don’t have “salesmen” at all. Palantir, the data analytics company I co-founded with my law school classmate Alex Karp, doesn’t employ anyone separately tasked with selling its product. Instead, Alex, who is Palantir’s CEO, spends 25 days a month on the road, meeting with clients and potential clients. Our deal sizes range from $1 million to $100 million. At that price point, buyers want to talk to the CEO, not the VP of Sales. Businesses with complex sales models succeed if they achieve 50% to 100% year-over-year growth over the course of a decade. This will seem slow to any entrepreneur dreaming of viral growth. You might expect revenue to increase 10x as soon as customers learn about an obviously superior product, but that almost never happens. Good enterprise sales strategy starts small, as it must: a new customer might agree to become your biggest customer, but they’ll rarely be comfortable signing a “deal completely out of scale with what you’ve sold before. Once you have a pool of reference customers who are successfully using your product, then you can begin the long and methodical work of hustling toward ever bigger deals

-

Most sales are not particularly complex: average deal sizes might range between $10,000 and $100,000, and usually the CEO won’t have to do all the selling himself. The challenge here isn’t about how to make any particular sale, but how to establish a process by which a sales team of modest size can move the product to a wide audience

-

In 2008, Box had a good way for companies to store their data safely and accessibly in the cloud. But people didn’t know they needed such a thing—cloud computing hadn’t caught on yet. That summer, Blake was hired as Box’s third salesperson to help change that. Starting with small groups of users who had the most acute file sharing problems, Box’s sales reps built relationships with more and more users in each client company. In 2009, Blake sold a small Box account to the Stanford Sleep Clinic, where researchers needed an easy, secure way to store experimental data logs. Today the university offers a Stanford-branded Box account to every one of its students and faculty members, and Stanford Hospital runs on Box. If it had started off by trying to sell the president of the university on an enterprise-wide solution, Box would have sold nothing. A complex sales approach would have made Box a forgotten startup failure; instead, personal sales made it a multibillion-dollar business

-

Sometimes the product itself is a kind of distribution. ZocDoc is a Founders Fund portfolio company that helps people find and book medical appointments online. “The company charges doctors a few hundred dollars per month to be included in its network. With an average deal size of just a few thousand dollars, ZocDoc needs lots of salespeople—so many that they have an internal recruiting team to do nothing but hire more. But making personal sales to doctors doesn’t just bring in revenue; by adding doctors to the network, salespeople make the product more valuable to consumers (and more consumer users increases its appeal to doctors). More than 5 million people already use the service each month, and if it can continue to scale its network to include a majority of practitioners, it will become a fundamental utility for the U.S. health care industry

-

In between personal sales (salespeople obviously required) and traditional advertising (no salespeople required) there is a dead zone. Suppose you create a software service that helps convenience store owners track their inventory and manage ordering. For a product priced around $1,000, there might be no good distribution channel to reach the small businesses that might buy it. Even if you have a clear value proposition, how do you get people to hear it? Advertising would either be too broad (there’s no TV channel that only convenience store owners watch) or too inefficient (on its own, an ad in Convenience Store News probably won’t convince any owner to part with $1,000 a year). The product needs a personal sales effort, but at that price point, you simply don’t have the resources to send an actual person to talk to every prospective customer. This is why so many small and medium-sized businesses don’t use tools that bigger firms take for granted. It’s not that small business proprietors are unusually backward or that good tools don’t exist: distribution is the hidden bottleneck

-

Marketing and advertising work for relatively low-priced products that have mass appeal but lack any method of viral distribution. Procter & Gamble can’t afford to pay salespeople to go door-to-door selling laundry detergent. (P&G does employ salespeople to talk to grocery chains and large retail outlets, since one detergent sale made to these buyers might mean 100,000 one-gallon bottles.) To reach its end user, a packaged goods company has to produce television commercials, print coupons in newspapers, and design its product boxes to attract attention. Advertising can work for startups, too, but only when your customer acquisition costs and customer lifetime value make every other distribution channel uneconomical. Consider e-commerce startup Warby Parker, which designs and sells fashionable prescription eyeglasses online instead of contracting sales out to retail eyewear distributors. Each pair starts at around $100, so assuming the average customer buys a few pairs in her lifetime, the company’s CLV is a few hundred dollars. That’s too little to justify personal attention on every transaction, but at the other extreme, hundred-dollar physical products don’t exactly go viral. By running advertisements and creating quirky TV commercials, Warby is able to get its better, less expensive offerings in front of millions of eyeglass-wearing customers. The company states plainly on its website that “TV is a great big megaphone,” and when you can only afford to spend dozens of dollars acquiring a new customer, you need the biggest megaphone you can find

-

Every entrepreneur envies a recognizable ad campaign, but startups should resist the temptation to compete with bigger companies in the endless contest to put on the most memorable TV spots or the most elaborate PR stunts. I know this from experience. At PayPal we hired James Doohan, who played Scotty on Star Trek, to be our official spokesman. When we released our first software for the PalmPilot, we invited journalists to an event where they could hear James recite this immortal line: “I’ve been beaming people up my whole career, but this is the first time I’ve ever been able to beam money!” It flopped—the few who actually came to cover the event weren’t impressed. We were all nerds, so we had thought Scotty the Chief Engineer could speak with more authority than, say, Captain Kirk. (Just like a salesman, Kirk was always showboating out in some exotic locale and leaving it up to the engineers to bail him out of his own mistakes.) We were wrong: when Priceline.com cast William Shatner (the actor who played Kirk) in a famous series of TV spots, it worked for them. But by then Priceline was a major player. No early-stage startup can match big companies’ advertising budgets. Captain Kirk truly is in a league of his own

-

A product is viral if its core functionality encourages users to invite their friends to become users too. This is how Facebook and PayPal both grew quickly: every time someone shares with a friend or makes a payment, they naturally invite more and more people into the network. This isn’t just cheap—it’s fast, too. If every new user leads to more than one additional user, you can achieve a chain reaction of exponential growth. The ideal viral loop should be as quick and frictionless as possible. Funny YouTube videos or internet memes get millions of views very quickly because they have extremely short cycle times: people see the kitten, feel warm inside, and forward it to their friends in a matter of seconds. At PayPal, our initial user base was 24 people, all of whom worked at PayPal. Acquiring customers through banner advertising proved too expensive. However, by directly paying people to sign up and then paying them more to refer friends, we achieved extraordinary growth. This strategy cost us $20 per customer, but it also led to 7% daily growth, which meant that our user base nearly doubled every 10 days. After four or five months, we had hundreds of thousands of users and a viable opportunity to build a great company by servicing money transfers for small fees that ended up greatly exceeding our customer acquisition cost

-

Whoever is first to dominate the most important segment of a market with viral potential will be the last mover in the whole market. At PayPal we didn’t want to acquire more users at random; we wanted to get the most valuable users first. The most obvious market segment in email-based payments was the millions of emigrants still using Western Union to wire money to their families back home. Our product made that effortless, but the transactions were too infrequent. We needed a smaller niche market segment with a higher velocity of money—a segment we found in eBay “PowerSellers,” the professional vendors who sold goods online through eBay’s auction marketplace. There were 20,000 of them. Most had multiple auctions ending each day, and they bought almost as much as they sold, which meant a constant stream of payments. And because eBay’s own solution to the payment problem was terrible, these merchants were extremely enthusiastic early adopters. Once PayPal dominated this segment and became the payments platform for eBay, there was no catching up—on eBay or anywhere else

-

Distribution follows a power law of its own. This is counterintuitive for most entrepreneurs, who assume that more is more. But the kitchen sink approach—employ a few salespeople, place some magazine ads, and try to add some kind of viral functionality to the product as an afterthought—doesn’t work. Most businesses get zero distribution channels to work: poor sales rather than bad product is the most common cause of failure. If you can get just one distribution channel to work, you have a great business. If you try for several but don’t nail one, you’re finished

- Most clean tech companies crashed because they neglected one or more of the seven questions that every business must answer:

- The Engineering Question: Can you create breakthrough technology instead of incremental improvements?

- The Timing Question: Is now the right time to start your particular business?

- The Monopoly Question: Are you starting with a big share of a small market?

- The People Question: Do you have the right team?

- The Distribution Question: Do you have a way to not just create but deliver your product?

- The Durability Question: Will your market position be defensible 10 and 20 years into the future?

- The Secret Question: Have you identified a unique opportunity that others don’t see?

-

Great companies have secrets: specific reasons for success that other people don’t see

- Tesla is one of the few cleantech companies started last decade to be thriving today. They rode the social buzz of cleantech better than anyone, but they got the seven questions right, so their success is instructive:

- TECHNOLOGY. Tesla’s technology is so good that other car companies rely on it: Daimler uses Tesla’s battery packs; Mercedes-Benz uses a Tesla powertrain; Toyota uses a Tesla motor. General Motors has even created a task force to track Tesla’s next moves. But Tesla’s greatest technological achievement isn’t any single part or component, but rather its ability to integrate many components into one superior product. The Tesla Model S sedan, elegantly designed from end to end, is more than the sum of its parts: Consumer Reports rated it higher than any other car ever reviewed, and both Motor Trend and Automobile magazines named it their 2013 Car of the Year.

- TIMING. In 2009, it was easy to think that the government would continue to support cleantech: “green jobs” were a political priority, federal funds were already earmarked, and Congress even seemed likely to pass cap-and-trade legislation. But where others saw generous subsidies that could flow indefinitely, Tesla CEO Elon Musk rightly saw a one-time-only opportunity. In January 2010—about a year and a half before Solyndra imploded under the Obama administration and politicized the subsidy question—Tesla secured a $465 million loan from the U.S. Department of Energy. A half-billion-dollar subsidy was unthinkable in the mid-2000s. It’s unthinkable today. There was only one moment where that was possible, and Tesla played it perfectly.

- MONOPOLY. Tesla started with a tiny submarket that it could dominate: the market for high-end electric sports cars. Since the first Roadster rolled off the production line in 2008, Tesla’s sold only about 3,000 of them, but at $109,000 apiece that’s not trivial. Starting small allowed Tesla to undertake the necessary R&D to build the slightly less expensive Model S, and now Tesla owns the luxury electric sedan market, too. They sold more than 20,000 sedans in 2013 and now Tesla is in prime position to expand to broader markets in the future.

- TEAM. Tesla’s CEO is the consummate engineer and salesman, so it’s not surprising that he’s assembled a team that’s very good at both. Elon describes his staff this way: “If you’re at Tesla, you’re choosing to be at the equivalent of Special Forces. There’s the regular army, and that’s fine, but if you are working at Tesla, you’re choosing to step up your game.”

- DISTRIBUTION. Most companies underestimate distribution, but Tesla took it so seriously that it decided to own the entire distribution chain. Other car companies are beholden to independent dealerships: Ford and Hyundai make cars, but they rely on other people to sell them. Tesla sells and services its vehicles in its own stores. The up-front costs of Tesla’s approach are much higher than traditional dealership distribution, but it affords control over the customer experience, strengthens Tesla’s brand, and saves the company money in the long run.

- DURABILITY. Tesla has a head start and it’s moving faster than anyone else—and that combination means its lead is set to widen in the years ahead. A coveted brand is the clearest sign of Tesla’s breakthrough: a car is one of the biggest purchasing decisions that people ever make, and consumers’ trust in that category is hard to win. And unlike every other car company, at Tesla the founder is still in charge, so it’s not going to ease off anytime soon.

- SECRETS. Tesla knew that fashion drove interest in cleantech. Rich people especially wanted to appear “green,” even if it meant driving a boxy Prius or clunky Honda Insight. Those cars only made drivers look cool by association with the famous eco-conscious movie stars who owned them as well. So Tesla decided to build cars that made drivers look cool, period—Leonardo DiCaprio even ditched his Prius for an expensive (and expensive-looking) Tesla Roadster. While generic cleantech companies struggled to differentiate themselves, Tesla built a unique brand around the secret that cleantech was even more of a social phenomenon than an environmental imperative